Let's Talk

Need Help Urgently?

Call our 24 hour rapid response team now on 0333 311 1090

Request a callback

"*" indicates required fields

The Right to Work compliance is a legal requirement for all UK employers to ensure that their employees have the legal right to work in the country. It is essential for employers to conduct thorough checks to prevent illegal working and maintain a lawful workforce. Failure to comply with Right to Work legislation can result in significant penalties and other enforcement actions by the Home Office.

We will discuss the key highlights of Right to Work compliance in the UK, including why it is important, the consequences of not conducting checks, and the different types of checks that employers can use. We will also explore the Employer Checking Service, follow-up checks, and the considerations that employers need to keep in mind regarding Right to Work compliance. Let’s dive in to understand more about Right to Work compliance in the UK and how it impacts employers.

The right to work is important in the UK to ensure that individuals have the legal permission to work in the country. It is crucial for employers to verify the immigration status of their employees to prevent illegal working and maintain a compliant workforce.

Employers who fail to conduct right to work checks can face severe consequences, including civil penalties and other enforcement actions by the Home Office. By conducting these checks, employers establish a statutory excuse against civil liability. This means that if an employer is found to be employing someone illegally but they have conducted the prescribed right-to-work checks, they will have a defence against any civil penalty. To assist employers in verifying an employee’s immigration status, the Home Office provides an Employer Checking Service. This service allows employers to verify an employee’s right to work by submitting their personal details and job title, along with the case ID or Home Office reference number linked to the employee’s application. The Employer Checking Service provides a positive verification notice (PVN) confirming the individual’s right to work in the UK.

By conducting right to work checks and utilising the Employer Checking Service, employers can ensure compliance with immigration laws and maintain a legal workforce.

Failing to conduct a right to work check can have severe consequences for employers in the UK. The Home Office has the power to impose civil penalties on employers who employ individuals without the legal right to work.

The civil penalties for employing illegal workers can be substantial. For a first breach, employers can face fines of up to £20,000 per illegal worker. For repeat breaches, the fines can increase to up to £30,000 per illegal worker. These penalties can quickly add up and have a significant impact on a company’s finances.

In addition to civil penalties, the Home Office can take enforcement action against employers who fail to conduct right to work checks. This can include criminal prosecution, which carries a maximum penalty of up to 5 years imprisonment, an unlimited fine, or both. Employers may also face other enforcement measures, such as the loss of their sponsor license or seizure of earnings made as a result of illegal working.

To avoid these severe consequences, it is crucial for employers to comply with the legal requirement of conducting right to work checks on all employees. By verifying the immigration status of their employees, employers can ensure they are employing individuals who have the legal right to work in the UK and avoid the penalties associated with employing illegal workers.

Proving your right to work in the UK is a legal requirement under the Immigration, Asylum, and

Nationality Act. This legislation requires all employers in the UK to check and retain evidence of each

employee’s legal right to work in the country.

The purpose of these checks is to verify an individual’s eligibility for employment in the UK. By

ensuring that employees have the legal right to work, employers can comply with immigration laws

and maintain a lawful workforce.

The Immigration Act sets out the legal requirements for right to work checks and defines the

penalties for non-compliance. Employers are required to obtain and check specific documents that

demonstrate an employee’s right to work, such as passports, immigration status documents, or birth

certificates. These documents provide evidence of an individual’s legal right to work in the UK.

Additionally, the Nationality Act may also be relevant in determining an individual’s right to work.

This legislation establishes the criteria for British citizenship and the rights associated with it.

Employers may need to consider the provisions of the Nationality Act when verifying an employee’s

right to work in the UK.

By proving your right to work in the UK, you are demonstrating your eligibility for employment and

complying with the legal requirements set out by the Immigration, Asylum, and Nationality Act.

Yes, it is a legal requirement for all employers in the UK to carry out right to work checks on their employees. These checks are mandated by the Home Office to ensure that employers only hire individuals who have the legal right to work in the country.

By conducting right to work checks, employers establish a statutory excuse against civil liability. This means that if an employer is found to be employing someone illegally, but they have conducted the prescribed right to work checks, they have a defence against any civil penalty.

The Home Office provides guidance on how employers should conduct these checks and the acceptable documents that can be used to prove an individual’s right to work. Employers are responsible for verifying the authenticity of the documents and ensuring that the individual presenting them is the rightful holder.

Employers can also utilise the Employer Checking Service provided by the Home Office to verify an employee’s immigration status. This service allows employers to submit the employee’s personal details and job title, along with the case ID or Home Office reference number linked to the employee’s application, to obtain a positive verification notice (PVN) confirming the individual’s right to work in the UK.

Overall, carrying out right to work checks is a legal requirement for employers in the UK and provides them with a defence against civil liability.

There are various ways in which employers can conduct right to work checks to verify an employee’s eligibility to work in the UK. The different types of checks include:

Key points about identity service provider Right to Work checks include:

Using an IDSP for right to work checks can improve accuracy, save time, and ensure compliance with right to work regulations.

Key points about online Right to Work checks using share codes include:

Key points about manual document Right to Work checks include:

Manual document Right to Work checks provide employers with a reliable way to verify an employee’s right to work when other types of checks are not applicable.

Share codes simplify online right to work checks, streamlining the verification process. Employers request a code from the Home Office, which applicants generate through the online service. This code allows secure access to the individual’s immigration status for a limited period. The system enhances efficiency and accuracy in confirming an individual’s right to work, ensuring compliance with regulations. By utilising share codes, employers can easily validate the legal right of prospective

employees to work in the UK.

Manual document right to work checks require thorough verification of original documents, such as passports or biometric residence permits, ensuring authenticity and validity. This process involves scrutinising expiration dates, photographs, and relevant visas or permits. Employers must follow the guidelines set by the Home Office to establish a prospective employee’s legal right to work in the UK.

By conducting these checks in the prescribed manner, companies can avoid penalties for employing individuals with uncertain immigration statuses.

The Employer Checking Service is a valuable tool provided by the Home Office to help employers

verify an employee’s immigration status and right to work in the UK. This service is particularly useful when employees cannot provide the required documents for other types of right to work checks or when their immigration status is pending a decision.

By using the Employer Checking Service, employers can obtain a positive verification notice (PVN)

that confirms an individual’s right to undertake work in the UK. This PVN provides employers with a

statutory excuse against civil liability for employing someone deemed to have no right to work.

Key points about the Employer Checking Service include:

Follow-up right to work checks are necessary for employees with time-limited permission to work in

the UK. These checks must be conducted shortly before the expiry date of the employee's existing grant of leave to remain in the UK.

Key points about follow-up Right to Work checks include:

Follow-up right to work checks are essential to ensure ongoing compliance and prevent the

employment of individuals without the legal right to work.

Employers need to consider various factors and obligations when it comes to compliance with the

right to work. These considerations are crucial for maintaining a lawful workforce and avoiding

penalties.

Key points about right to work employer considerations include:

By considering these factors, employers can maintain compliance with right to work laws, establish a

statutory excuse, and avoid penalties for employing individuals without the legal right to work.

What are right to work checks?

Right to work checks are an essential process for employers in the UK to verify that their employees have the legal right to work in the country. These checks are conducted in a prescribed manner and provide employers with a statutory excuse against civil liability.

Key points about right to work checks include:

Right to work checks are a legal requirement for all employers in the UK and play a crucial role in preventing illegal working and maintaining a compliant workforce.

Are right to work checks a legal requirement?

Yes, right to work checks are a legal requirement for all UK employers. The Immigration, Asylum, and Nationality Act 2006 make it mandatory for employers to check and retain evidence of each employee’s legal right to work in the UK.

Key points about the legal requirement of right to work checks include:

It is essential for employers to understand and comply with the legal requirement of right to work checks to ensure they are employing individuals with the legal right to work in the UK.

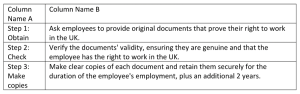

What are the three steps of a right to work document check?

The three steps of a right to work document check are essential for employers to ensure that their employees have the legal right to work in the UK. These steps are:

It is important for employers to follow these three steps to establish a statutory excuse against any civil liability. By conducting a prescribed right to work check and retaining copies of the documents, employers can avoid fines and penalties for employing someone illegally.

How long do right to work checks take?

The time it takes to complete a right to work check can vary depending on the type of check being conducted.

Here are some factors to consider:

In general, online checks and the services of an IDSP can help streamline the right to work check process, making it faster and more efficient. However, employers should still allow sufficient time to complete the necessary checks and ensure compliance with legal requirements.

We are always happy to talk about any legal concern you may have regarding criminal law matters.

Get In Touch

Call our 24 hour rapid response team now on 0333 311 1090

"*" indicates required fields

"*" indicates required fields